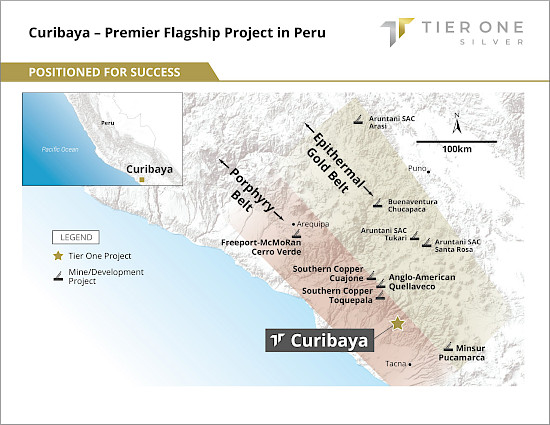

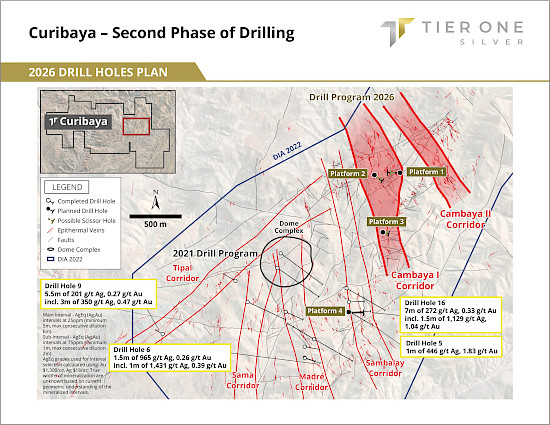

Vancouver, Canada – January 8, 2026 – Tier One Silver Inc. (TSXV: TSLV) (OTCQB: TSLVF) (FSE: TOV0) (“Tier One” or the “Company”) is pleased to announce that it has commenced preparations to drill the Cambaya target area of its high-grade Curibaya epithermal silver-gold-copper project located in Tacna, Peru (Figure 1) through its wholly owned Peruvian subsidiary, Magma Minerals S.A.C. The diamond drill program (“Phase 2 Drilling”), which will be the first follow up drilling on the Curibaya project since the Company’s successful inaugural drill program was completed in 2021 (see result highlights below), is targeted to be completed in Q1 2026. Phase 2 Drilling is expected to consist of approximately 1,150 metres (m) using one drill rig (Figure 2) first targeting the high-grade silver-gold epithermal mineralization defined at surface in the Cambaya area which has not been drilled to date.

Summary of Phase 2 Drilling Plans:

- Initial 1,150 m of diamond drilling in Q1 2026 to include seven (7) drill holes from four (4) platforms, with one drill rig and an average depth of 150 m - 250 m per hole

- Drilling objective is to test below four high-grade channel samples taken from the Cambaya 1 corridor in the upper part of the epithermal system:

- 22CRT-80 – 4.5 m of 408 g/t silver (Ag), 1.48 g/t gold (Au), including 1 m of 1,768 g/t Ag, 6.33 g/t Au

- 21CRT-55 – 20 m of 243 g/t Ag, 0.71 g/t Au, including 7 m of 667 g/t Ag, 1.48 g/t Au

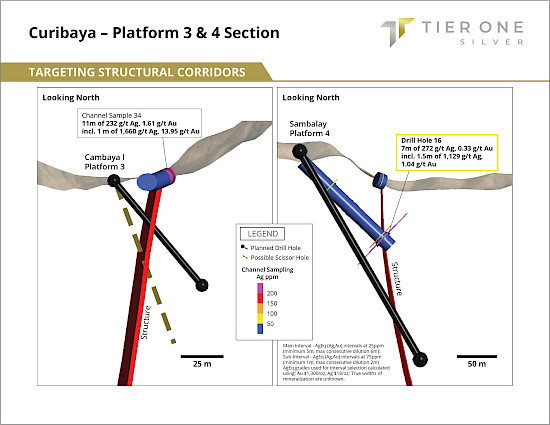

- 21CRT-34 – 11 m of 232 g/t Ag, 1.61 g/t Au, including 1 m of 1,660 g/t Ag, 13.95 g/t Au

- 21CRT-56 – 8 m of 349 g/t Ag, 0.46 g/t Au, including 1 m of 2,680 g/t Ag, 3.14 g/t Au

Phase 1 Drilling Highlights:

- Top intercepts from the Phase 1 discovery drill program include:

- 21CUR-016 – 7 m of 272 g/t Ag, 0.33 g/t Au, including 1.5 m of 1,129 g/t Ag, 1.04 g/t Au (Sambalay corridor)

- 21CUR-006 – 1.5 m of 965 g/t Ag, 0.26 g/t Au, including 1 m of 1,431 g/t Ag, 0.39 g/t Au (Madre corridor)

- 21CUR-009 – 3 m of 350 g/t Ag, 0.47 g/t Au (Tipal corridor)

- 21CUR-005 – 1 m of 446 g/t Ag, 1.83 g/t Au (Sambalay corridor)

Figure 1: Illustrates the position of the Curibaya Project with respect to the large copper porphyry mines in Southern Peru.

Phase 2 Drill Plan and Objectives

Phase 2 Drilling is planned to consist of seven (7) diamond drill holes from four (4) platforms (Figure 2) for approximately 1,150 m of drilling in Q1 2026. The average depth of each hole is anticipated to be between 150 m - 250 m per hole, however, depth will vary based on the progress of each hole.

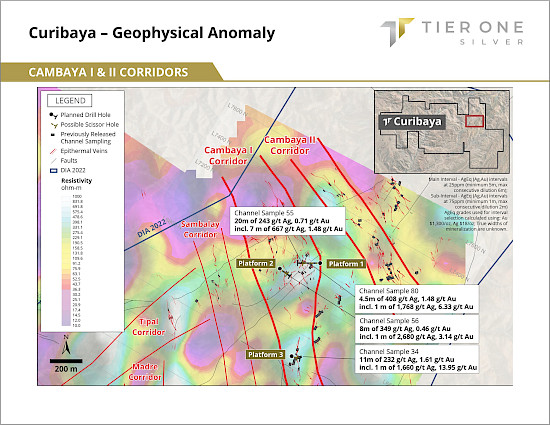

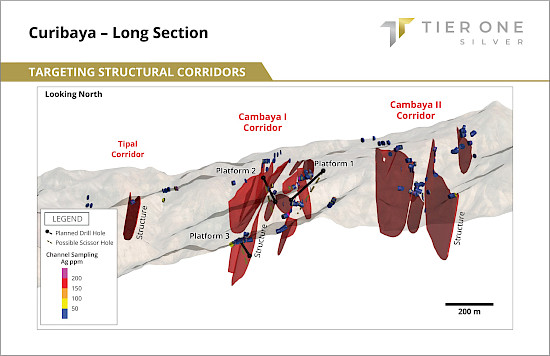

Drilling will commence in the Cambaya 1 corridor, which has not yet been drilled. The Cambaya area is composed of two corridors (Cambaya 1 and Cambaya 2) located in the upper part of the epithermal system believed to be the preferred zonation for the silver mineralization discovered to date and more than 250 m higher in topography than the corridors tested in the 2021 Phase 1 drill program. Extensive surface mapping and channel sampling work to date has identified numerous targets where silver and gold mineralization are exposed in multiple different areas of the Cambaya corridors (Figure 4).

The program aims to test the vertical continuity of mineralization underneath high-grade silver gold channel sampling results in the Cambaya area and test high resistivity (>400 ohm-m) geophysical features that correlates with quartz - silica structures (Figure 3). The high-priority target areas are where the Company believes silver gold-rich fluids have concentrated, resulting in potentially substantial silver-gold accumulations as seen in other precious metal vein deposits in Peru.

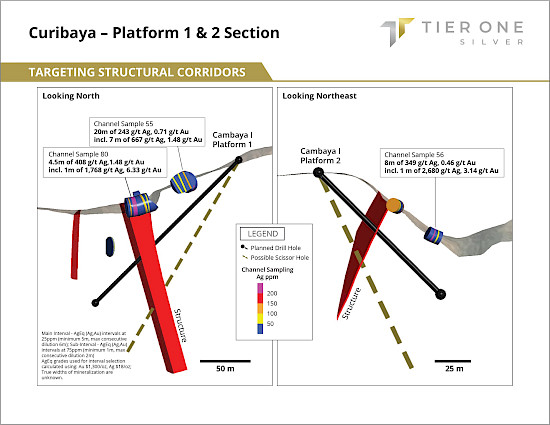

The program is planned to include scissor holes from multiple platforms, when warranted, to test the geometry of the epithermal structures identified at surface, one of which is a scissor hole below hole 16 (21CUR-016) of the 2021 Phase 1 drill program, which yielded 7 m of 272 g/t Ag, 0.33 g/t Au, including 1.5 m of 1,129 g/t Ag, 1.04 g/t Au, with the aim of testing 70 m below the 1,129 g/t Ag, 1.04 g/t Au interval (Figure 5).

All planned Phase 2 drilling is within the permitted area of the Company’s current drill permit held through its subsidiary, Magma Minerals S.A.C., which is in place until October 2026 and allows for up to 200 drill holes from 22 drill pads. The current permitted area also encompasses the Cambaya 2 corridor where additional targets have been identified. Subject to initial drill results and additional financing, the Company may look to expand drilling activities in this prospective area.

Peter Dembicki, CEO and President of Tier One commented, “We are very excited to commence our Phase 2 drill program at Curibaya, which will focus on the high-priority Cambaya 1 corridor — an area that sits 250 meters higher in elevation than our Phase 1 drill sites and has demonstrated high-grade silver and gold grades at surface. Building on our first-phase results, which included high-grade intercepts such as 1 m of 1,431 g/t Ag, 0.39 g/t Au and 1.5 m of 1,129 g/t Ag, 1.04 g/t Au, this next round of drilling is designed to test directly beneath where high-grade channel samples were taken and expand our understanding of the precious-metal window identified in the northeast portion of the project. We are excited to resume drilling, supported by the continued strength in the silver and gold markets.”

Table 1: Highlights from previous channel sampling

| Channel ID | From (m) | To (m) | Length (m) | Ag (g/t) | Au (g/t) | |

| 21CRT-34 | 26.0 | 37.0 | 11.0 | 232.1 | 1.61 | |

| Incl. | 34.0 | 35.0 | 1.0 | 1,660.0 | 13.95 | |

| 21CRT-36 | 19.0 | 28.0 | 9.0 | 409.0 | 0.41 | |

| Incl. | 22.0 | 25.0 | 3.0 | 949.7 | 0.82 | |

| 21CRT-44 | 6.0 | 8.0 | 2.0 | 1,074.0 | 0.53 | |

| 21CRT-52 | 8.0 | 10.0 | 2.0 | 1,736.5 | 1.61 | |

| Incl. | 8.0 | 9.0 | 1.0 | 3,170.0 | 2.00 | |

| 21CRT-55 | 4.0 | 24.0 | 20.0 | 242.7 | 0.71 | |

| 21CRT-56 | 2 | 10 | 8 | 349.1 | 0.46 | |

| Incl. | 6 | 7 | 1 | 2,680.0 | 3.14 | |

| 22CRT-080 | 2.5 | 7 | 4.5 | 408.2 | 1.48 | |

| Incl. | 2.5 | 3.5 | 1 | 1,768.0 | 6.33 | |

| 22CRT-101 | 0.5 | 3.0 | 2.5 | 136.4 | 0.82 | |

| Incl. | 2.5 | 3.0 | 0.5 | 568.0 | 3.37 | |

| 24CRT-164 | 1 | 2 | 1 | 151.5 | 0.09 | |

| Incl. | 1 | 1.5 | 0.5 | 280.0 | 0.14 | |

| 24CRT-167 | 0.5 | 2 | 1.5 | 3,095.6 | 1.72 | |

| Incl. | 1 | 1.5 | 0.5 | 8,950.0 | 4.13 | |

| 24CRT-168 | 1 | 1.5 | 0.5 | 185.0 | 0.56 | |

| 24CRT-169 | 0.5 | 1.5 | 1 | 161.7 | 0.11 | |

| Incl. | 0.5 | 1 | 0.5 | 292.0 | 0.17 | |

| 24CRT-172 | 1 | 1.5 | 0.5 | 262.0 | 1.63 | |

| 24CRT-173 | 0.5 | 1 | 0.5 | 233.0 | 0.32 |

|

Main Interval >= 25ppm AgEq, Sub-Interval >= 75ppm AgEq |

Figure 2: Illustrates a general location map of the proposed four drill platforms for the second phase of drilling at the Curibaya Project.

Figure 3: Correlation between resistors with Cambaya I and Cambaya II corridors and structures.

Figure 4: Platforms 26CUR001 and 26CUR002

Figure 5: Platforms 26CUR003 and 26CUR004

Summary of Phase 1 Drill Program

The key technical advancement from the first phase of drilling at Curibaya was the recognition of a precious metals window that is linked to higher elevations within the project area. The ridges that host the veins within the Tipal, Sama, Madre and Sambalay corridors have a maximum elevation of approximately 2,100 m, whereas vein mineralization in the northeastern area of the project, the Cambaya target area, has elevations of approximately 2,200 m – 2,400 m (Figure 6). Given the increase in elevation of up to approximately 300 m, the outcropping epithermal veins from southwest to northeast, and the higher stratigraphic level to the northeast, the Company has interpreted that there has been less erosion in the northeast area of the project and therefore there is a higher potential for preserved epithermal mineralization. This is corroborated with the observed illite- smectite clay alteration.

Figure 6: Longitudinal Section looking to the North, see changes in elevation and location of first three platforms.

The precious metals window observed at Cambaya indicates an erosion level approximately 150 m below the paleo water table, whereas vein outcrops to the southwest have been eroded approximately 300 m deeper at the Sama, Tipal, and Madre corridors. This demonstrates that the corridors in the southwest are 450 m beneath the paleosurface, which is consistent with the common illite alteration observed within those corridors. At the Cambaya area, high arsenic anomalies at surface indicate that the Ag – Au horizon is preserved and close to surface. This provides a precious metals corridor of approximately 300 m – 400 m within the Cambaya target area with high-grade channel sampling results (see highlights section). In addition, Tier One’s technical team believes that the 1 km northern extension from drill hole 21CUR-016 that intercepted 1.5 m of 1,129 g/t Ag, 1.04 g/t Au at the Sambalay corridor is highly prospective, as elevation is gained to the north toward Cambaya, and therefore the vertical extent of the precious metals window is increasing in that direction (Figure 6).

Table 2: Highlights from Phase 1 Program

| Corridor | Hole ID | From (m) |

To (m) |

Length (m) |

Ag (g/t) |

Au (g/t) |

Zn % |

Pb % |

||

| Madre | 21CUR-001 | 1 | 166 | 197 | 31 | 15.8 | 0.03 | 0.185 | 0.02 | |

| Madre | 21CUR-003 | 1 | 43 | 54 | 11 | 68.8 | 0.21 | 0.003 | 0.02 | |

| Incl.2 | 50 | 54 | 4 | 173.8 | 0.50 | 0.003 | 0.03 | |||

| Sambalay | 21CUR-005 | 1 | 161 | 162 | 1 | 446.0 | 1.83 | 0.026 | 0.01 | |

| Madre | 21CUR-006 | 1 | 107.5 | 111 | 3.5 | 418.7 | 0.12 | 0.184 | 0.16 | |

| Incl.2 | 108 | 109 | 1 | 1,431.0 | 0.39 | 0.182 | 0.343 | |||

| Madre | 21CUR-008 | 1 | 192 | 200.5 | 8.5 | 15.0 | 0.19 | 0.741 | 0.38 | |

| Incl.2 | 197 | 199.5 | 2.5 | 41.3 | 0.47 | 1.746 | 0.972 | |||

| 1 | 209 | 237 | 28 | 8.2 | 0.12 | 0.392 | 0.06 | |||

| Incl.2 | 213 | 215 | 2 | 26.9 | 0.50 | 0.788 | 0.120 | |||

| and | 232.5 | 235 | 2.5 | 23.4 | 0.19 | 1.028 | 0.081 | |||

| 2 | 269 | 271 | 2 | 32.7 | 0.13 | 2.010 | 0.585 | |||

| Tipal | 21CUR-009 | 1 | 82 | 87.5 | 5.5 | 200.8 | 0.27 | 0.012 | 0.01 | |

| Incl.2 | 83 | 86 | 3 | 349.7 | 0.47 | 0.011 | 0.013 | |||

| Sambalay | 21CUR-015 | 2 | 153 | 154.5 | 1.5 | 216.0 | 0.11 | 0.113 | 0.009 | |

| Sambalay | 21CUR-016 | 1 | 139 | 146 | 7 | 272.3 | 0.33 | 0.046 | 0.03 | |

| Incl.2 | 142.5 | 144 | 1.5 | 1,128.7 | 1.04 | 0.146 | 0.085 | |||

| 1. AgEq (Ag,Au) intervals at 25ppm (minimum 5m, max consecutive dilution 6m) 2. AgEq (Ag,Au) intervals at 75ppm (minimum 1m, max consecutive dilution 2m) AgEq grades used for interval selection only, were calculated using: Au $1,300/oz, Ag $18/oz; True widths of mineralization are unknown due to the unknown mineralized zones orientation. See news releases dated November 4 & 18, 2021,January 24 &February 14, 2022 |

||||||||||

Qualified Person

Christian Rios (SVP of Exploration), P.Geo, is the Qualified Person who has reviewed and approved the technical contents of this press release.

ON BEHALF OF THE BOARD OF DIRECTORS OF TIER ONE SILVER INC.

Peter Dembicki President, CEO and Director

For further information on Tier One Silver Inc., please contact the Company at (778) 729-0700 or visit the Company’s website: www.tieronesilver.com

About Tier One Silver

Tier One Silver is an exploration company focused on creating value for shareholders and stakeholders through the discovery of world-class silver, gold and copper deposits in South America. The Company is focused on its flagship exploration project, Curibaya, but continues to investigate other potential projects of merit. The Company’s management and technical teams have a strong track record in raising capital, discovery and monetization of exploration success.

Channel Sampling

Analytical samples were taken from each 1-metre interval of channel floor resulting in approximately 2-3 kg of rock chips material per sample. Collected samples were sent to ALS Lab in Arequipa, Peru for preparation and then to Lima, Peru for analysis. All samples are assayed using 30 g nominal weight fire assay with atomic absorption finish (Au-AA25) and multi-element four acid digest ICP-AES/ICP-MS method (ME-MS61). Where MS61 results were greater or near 10000 ppm Cu, 10000 ppm Pb or 100 ppm Ag the assay were repeated with ore grade four acid digest method (Cu, Pb, Ag-OG62). Where OG62 results were greater or near 1500 ppm Ag the assay were repeated with 30 g nominal weight fire assay with gravimetric finish (Ag-GRA21). QA/QC programs for channel samples using internal standard and blank samples; field and lab duplicates indicate good overall accuracy and precision.

Silver equivalent grades (AgEq), which were use for interval selection only, were calculated using a $1300/oz gold price and $18/oz silver price. AgEq = Ag (ppm) + Au (ppm) * (Ag $/troy oz/Au $/troy oz). No metallurgy recoveries were used for the AgEq calculation.

Main Interval - AgEq (Ag, Au) intervals at 25 ppm (minimum 5 m, max consecutive dilution 6 m)

Sub-Interval - AgEq (Ag, Au) intervals at 75 ppm (minimum 1 m, max consecutive dilution 2 m).

True widths of mineralization are unknown due to the unknown mineralized zones orientation.

Drilling

Analytical samples were taken by sawing HQ or NQ diameter core into equal halves on site and sent one of the halves to ALS Lab in Arequipa, Peru for preparation and then to Lima, Peru for analysis. All samples are assayed using 30 g nominal weight fire assay with atomic absorption finish (Au-AA25) and multi-element four acid digest ICP-AES/ICP-MS method (ME-MS61). Where MS61 results were greater or near 10,000 ppm Cu, 10,000 ppm Pb or 100 ppm Ag the assay were repeated with ore grade four acid digest method (Cu, Pb, Ag-OG62). Where OG62 results were greater or near 1,500 ppm Ag the assay were repeated with 30 g.

QA/QC programs for 2021 core samples using company and lab duplicates, standards and blanks indicate good accuracy and precision in a large majority of standards assayed.

Silver equivalent grades (AgEq), which were used for interval selection only, were calculated using silver price of US$18/oz and gold price of US$1,300/oz. Metallurgical recoveries were not applied to the silver equivalent calculation.

Main Interval - AgEq (Ag, Au) intervals at 25 ppm (minimum 5 m, max consecutive dilution 6 m)

Sub-Interval - AgEq (Ag, Au) intervals at 75 ppm (minimum 1 m, max consecutive dilution 2 m)

True widths of mineralization are unknown due to the unknown mineralized zones orientation.

Forward Looking Information and General Cautionary Language

This news release contains forward-looking statements and forward-looking information within the meaning of Canadian securities legislation (collectively, “forward-looking statements”) that relate to the Company’s current expectations and views of future events in connection with the drill program. Forward-looking statements are not historical facts and therefore may involve estimates, assumptions and uncertainties which could cause actual results or outcomes to differ materially from those expressed in such forward-looking statements. No assurance can be given that these expectations will prove to be correct and such forward-looking statements included in this news release should not be heavily relied upon. These statements speak only as of the date of this news release.

Readers should refer to the risks discussed in the Company's Annual Information Form and Management’s Discussion & Analysis for the year ended December 31, 2024, and subsequent continuous disclosure filings with the Canadian Securities Administrators available at www.sedarplus.ca.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.